Scopes for CA

- A can choose to start up their own independent practice or make their clients on the basis of merit.

- They can also apply for the job of Chartered Accountantin an existing firm.

- They can also give their services for the capital market.

- The qualified CA can apply for a government job, public or private sectors both.

- The CA can also play an important role in the firm in taking quick decision and make profits for the firm.

- Current Package for CA in Abroad according to the U.S. Bureau of Lab or Statistics, most accountant or auditor earned money $ 40,370 up to $ 113,740

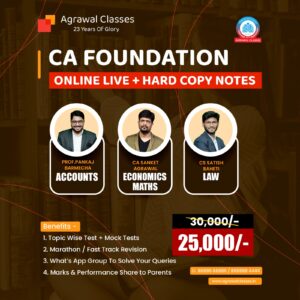

Steps In CA Foundation Course

- 1st Step: Pass 10+2 and then register with the Board of Studies (BOS). Do registration by December 31 for CA Foundation May Session and by June 30 for the November session.

- The CA can also play an important role in the firm in taking quick decision and make profits for the firm.

- Current Package for CA in Abroad according to the U.S. Bureau of Lab or Statistics, most accountant or auditor earned money $ 40,370 up to $ 113,740

The registration process is online, and one-time successful registration will be valid for three years. The candidate can apply and appear for a maximum of six attempts. CA Foundation Online Registration apply through the ICAI Exam official website – icaiexam.icai.org

Registration is open throughout the year, and the candidate can register with BOS, and the fee detail for registration is – For Indian Nationals Rs – 9800/- For Foreign Students USD – 780$

CA Foundation exam which is conducted in May or November every year and application windows gets open for a time period. The Application fee details are provided below. For Indian Centers – Rs. 1500 For Katmandu (Nepal) – Rs. 2200 For Oversea Centers – US$ 325